(Bloomberg) — OPEC may be celebrating an historic deal to extend supply cuts, but after the party, the organization will face a trio of questions it left unanswered.

Will the lucrative yet delicate relationship between Saudi Arabia and Russia survive the life of the agreement? Will surging U.S. shale output prove too much temptation for OPEC countries to stick to their own production promises? And, perhaps most perplexing: What does OPEC have planned long-term?

The deal to maintain the cut another nine months, hammered out this week in Vienna, could expire in March with a return to OPEC’s pump-at-will policy that prevailed between 2014 and 2016 and pushed prices below $30 a barrel. Or the organization could keep adjusting production.

“What concerns me is that there is no clear messaging around the exit strategy,” Ebele Kemery, head of energy investing at JPMorgan Asset Management, told Bloomberg TV. “The way we look at the market going forward, there’s going to be oversupply in 2018. They’re talking about price stability. To get price stability we need to know what the end-game is.”

Kemery’s concern over a lack of strategy appeared to be widespread. Brent crude fell 5% to $51.24 a barrel on the decision, wiping out most of the gains since Russia and Saudi Arabia publicly backed the nine-month extension last week.

New Floor

Despite an admission that November’s landmark agreement to limit output failed to eliminate the global oil glut, the commitment of two-dozen oil-producing countries did succeed in establishing a new floor for prices that’s well above the lows seen last year.

“OPEC is settling in for the long haul,’’ said Roger Diwan, an OPEC watcher at consultant IHS Markit Ltd. in Washington. “I think we’ll remain between $50 and $60 a barrel for the time being.’’

The agreement, which includes countries accounting for 60% of the world’s oil production, has already delivered for national budgets from Moscow to Tehran, as higher prices outweighed lower production.

“This is a historic deal, it already was in November and now still more,’’ said Jan Stuart, chief energy economist at Credit Suisse Group AG. “Now we have more confidence of a 2017 rebalance.’’

The extension to March prolongs a rare period of collaboration between the Organization of Petroleum Exporting Countries and some of its biggest rivals. The last time both sides worked together was 15 years ago. Back then, the agreement fell apart soon after it was made.

Alexander Novak, Russia’s energy minister, said the relationship between OPEC and non-members of the cartel was at a “pivotal moment.’’

Shifting Calculus

The calculus may shift in 2018, testing the increasingly close cooperation between Saudi Arabia and Russia, according to Ronald Smith, senior oil analyst at Citigroup Inc. in Moscow. It may not be in the best interest of Vladimir Putin’s balance sheet to keep new oilfields on the shelf. The lost revenue would be felt mostly by state-owned Rosneft PJSC on projects scheduled to ramp up production in 2018 and 2019.

“Rosneft, the state-owned champion, will have invested a lot of money in these fields that will be sitting idle if they continue to extend the agreement,’’ Smith said. “The math is going to be more ambiguous going forward. At some point they may decide they need to take back some market share.’’

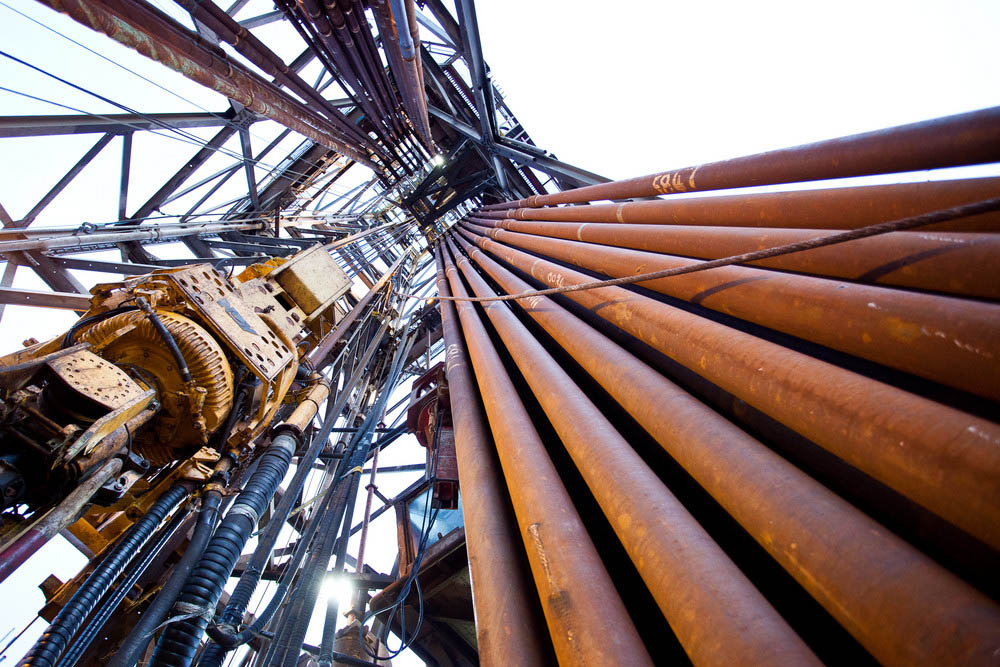

Also a contender in the battle for market share — and producers who didn’t sign on to the Vienna agreement — are U.S. shale drillers, who could benefit from this week’s deal.

Higher Inventories

Resurgent U.S. production has meant oil inventories remain well above the level targeted by OPEC ministers.

Analysts at energy consultant Wood MacKenzie said the deal extension would help U.S. shale oil output accelerate to its fastest growth rate in years. In 2018, global oil inventories would increase by about 600,000 barrels a day in the first quarter, followed by about 500,000 each quarter for the rest of the year.

“There’s still an oversupply to wrestle with,” said Simon Flowers, chief analyst at the consultant.

Even so, after more than two years of flip-flopping from market management to pump-at-will and back again, it’s not clear what OPEC will do next.

As recently as March, the production ceiling was envisaged as a short-term prop to rapidly bring a glut of global oil inventories back to historically typical levels.

In March, Saudi Oil Minister Khalid Al-Falih told an industry conference in Houston that the kingdom’s policy was to manage output “for a restricted period of time, with the aim of accelerating rebalancing, and then allowing the free market to work.”

That is exactly what some fear, and Al-Falih did not dispel those concerns on Thursday, telling Bloomberg, “This is not a structural intervention.’’

With the deal agreed to, Al-Falih said he expected OPEC to achieve its goal of returning global oil inventories to their five-year average by the end of the year. He reiterated a pledge “to do whatever it takes” to rebalance the market.

If Al-Falih’s optimistic outlook is correct, OPEC may not need a clear exit strategy.

“The exit strategy for OPEC is, eventually, when the market is tight enough, start to cheat on the cuts,’’ said Gary Ross, global head of oil at PIRA Energy Group, part of S&P Global Inc.

Bloomberg News by Javier Blas and Jack Farchy