Governors of six Northeast states deeply committed to offshore wind are pleading for more help from the Biden administration, as they face the possibility that wind developers may pull the plug on their renewable energy hopes.

“Instead of continued price declines, offshore wind faces cost increases in orders of magnitude that threaten states’ ability to make purchasing decisions,” the governors warned in a Sept. 13 letter to President Biden. “These pressures are affecting not only procurements of new offshore wind but, critically, previously procured projects already in the pipeline.

“Absent intervention, these near-term projects are increasingly at risk of failing. Without federal action, offshore wind deployment in the U.S. is at serious risk of stalling because states’ ratepayers may be unable to absorb these significant new costs alone.”

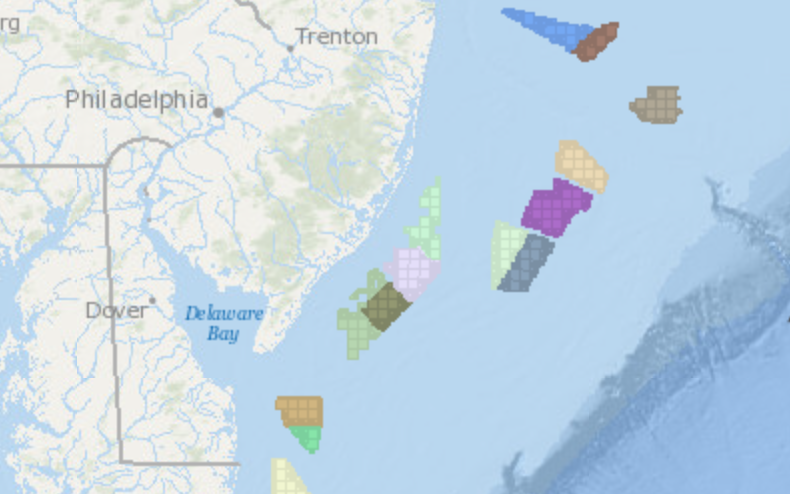

Six states that signed onto the letter – Massachusetts, Rhode Island, Connecticut, New York, New Jersey, and Maryland – are banking on buying power from planned offshore wind projects. It’s a key part of their future energy planning, looking to renewable sources of wind and solar power.

Meanwhile natural gas producers – aggressively marketing themselves as the “bridge fuel” to the energy future – continue to pick up the slack in the region, as aging nuclear reactors approach retirement age.

Offshore wind advocates portray future offshore wind turbine arrays as the green replacement. But now wind developers are seeking to negotiate new, higher prices for future projects off Massachusetts and New York. Partners Equinor and BP off Long Island near the New York Harbor approaches are seeking major increases in their contract prices.

“Application of Empire/Beacon’s request would result in a 54% increase on average across its portfolio of projects,” according to a document filed with regulators at the New York Public Service Commission by the New York State Energy Research and Development Authority (NYSERDA).

The “strike price” for Empire Wind 1 would rise from $118.38 per megawatt-hour (MWh) to $159.64/MWh and for Empire Wind 2 from $107.50/MWh to $177.84/MWh. Beacon Wind would see the strike price rise from 118.00/MWh to 190.82/MWh.

Meanwhile for their Sunrise Wind project, developers Ørsted and Eversource are looking for a 27% step-up, from $110.37/MWh to $139.99/MWh.

NYSERDA said developers “cite an unexpected and unforeseeable rise in inflation and supply chain costs and constraints associated with, among other things, the Covid-19 pandemic and the Russian invasion of Ukraine.” As a result, the authority said, projects now in development are “no longer be economically viable under existing contract pricing terms.”

Industry heavyweight Ørsted shook up the industry when it warned it may take a $2.3 billion write-down on the value of its U.S. offshore wind projects. New Jersey Gov. Phil Murphy, one of the signatories to the letter to Biden, is fighting opposition to offshore wind from Republican legislators. To keep Ørsted’s Ocean Wind 1 project viable off New Jersey, Democratic state legislators allied with Murphy approved steering another $200 million in federal renewable energy tax credits to the company during last-minute budget negotiations June 30.

But the states’ ability to boost subsidies is limited. The governors want the Biden administration to boost federal tax credits for offshore wind developers, give their states a share of revenue from offshore energy leases and hasten permitting for the projects.

Among their specific proposals is a first-ever cut of BOEM lease revenues to the states — a necessity to keep escalating costs from falling to electric ratepayers. Offshore wind opponents have long argued that projects will drive up costs, so the prospect of higher pricing is raising political anxiety for state governments.

The governors’ letter called to establish a new revenue sharing program for federal offshore wind leasing. At present, they wrote “federal law requires that all revenue generated from offshore wind leases beyond state waters be returned to the U.S. Treasury, leaving ratepayers to bear the brunt of the development costs for these critical projects. The lease revenue is a cost to offshore wind developers, meaning that states’ electricity ratepayers will bear the cost of leases for projects that ultimately interconnect into states’ electric grids.”

Notably absent from the governors’ letter was Virginia, where Dominion Energy is pressing on with its 2,600-megawatt Coastal Virginia Offshore Wind project. Planned by the company as an array of 176 wind turbine generators within 23.5 miles of Virginia Beach, the federal Bureau of Ocean Energy Management issued its environmental impact statement on the project in September.

It was some cheerful news for the battered wind sector.

“Dominion’s CVOW project is anchoring a critical corner of the emerging domestic supply chain and advancing this project means supporting development of America’s first wind turbine installation vessel and substantial port redevelopment work,” said John Begala, vice president for federal and state policy at the Business Network for Offshore Wind. “The Hampton Roads area is abuzz with offshore wind activity and the federal government’s advancement of the CVOW project will continue advancing the area as a hub for the whole industry.”

.jpg.small.400x400.jpg)