Where is the recovery in offshore drilling activity? The bulls will tell you it's just around the corner, but it has so far failed to materialize for offshore supply vessel (OSV) companies in the Americas.

If we step back and look at the Western Hemisphere as one big market, then the Americas OSV market has remained largely flat since October 2018 when the market hit a low of 85 contracted rigs across both continents. Since then it's been hovering at 88 contracted mobile rigs (semisubmersibles, drillships and jackups), supported by 397 offshore supply vessels (PSV, AHTS and AHT). While production facilities require long term support, drilling activity drives new OSV demand, and rig utilization remains poor. Operators have been enjoying a prolonged period of lower costs for vessels and rigs.

AMERICAS OVERVIEW

Even though immediate platform supply vessel (PSV) availability for vessels has tightened, raising spot market rates in the U.S. Gulf, new term charters have remained between $15,000-$22,000/day due to an oversupply of tonnage. Given enough advanced notice, there are plenty of vessels available for long term charters throughout the Americas. Day rates have improved significantly from the lows seen in 2017 when rates were at or below operating costs. The two big drivers of the Americas have historically been the U.S. Gulf and Brazil, both of which have lacked a critical mass of offshore projects to substantially raise OSV day rates into profitable territory. Instead minor rate increases have been pushed by a tightening of immediate availability in regional supplies.

Offshore activity in the U.S. Gulf has failed to recover sufficiently to absorb the oversupply of PSVs. While OSV demand in the U.S. Gulf is up from a year ago, overall drilling activity has been largely flat since January 2019 forcing OSV owners to market vessels into Latin America and even further abroad to West Africa. Places like Canada and Trinidad have proven be stable OSV markets, and much of the new action is in Guyana and Mexico.

US GULF OUTLOOK

Equinor is scheduled to begin a three-month campaign with the drillship Pacific Khamsim in November 2019. BP is expected to begin a one-year term with the drillship Ocean BlackHornet in January 2020. Deepwater rig demand has been flat all year, but it could fall as rigs roll off contract. In early July three drillships were expected to come off charter for Anadarko, Talos Energy and W&T Offshore.

Shallow water vessel demand dipped by five term charters with the conclusion of one jackup program in April. Cantium Energy has a two-month pause on jackup Enterprise 205, which is expected to resume its contract in August 2019. Term charters for PSVs less than 3,999 dwt fell from 62 to 57 in June. The supply of available vessels on the spot market tightened up a little, keeping rates firm.

AMERICAS COLD STACK REPORT

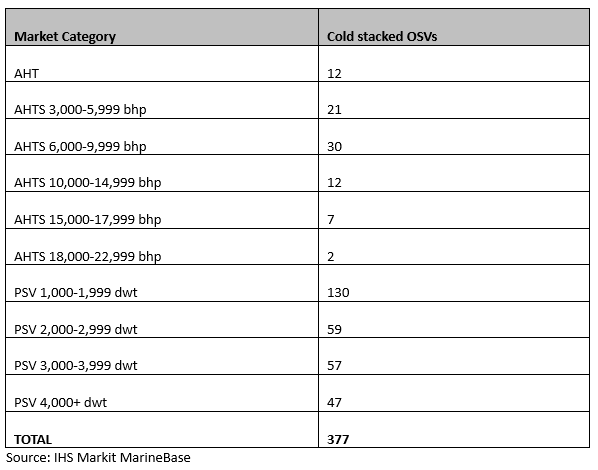

We have over 370 OSVs laid up all over North and South America, but stacked vessels are most concentrated in the U.S. Gulf (230), South America (84), and Mexico (51) and Central America (12). The vessel types laid up varies. While the majority are (130) small PSVs less than 1,999 dwt, all types of PSVs and AHTS are in the weeds. Some of them might never work again, but the newer ones can be activated for the right day rate and length of charter. PSVs greater than 4,000 dwt are mostly laid up in the U.S. (27) and Brazil (18).

COLD STACKED OSVs

AMERICAS DEMAND OUTLOOK

Currently, I'm generally pessimistic about the offshore demand outlook in the Americas. The North American shale is sopping up much of the new E&P investment in the Americas. Offshore exploration has picked up, but many of the drilling programs are very short, often for one to three wells. Before 2014 we were seeing rig contractors negotiate multiyear contracts. The oil companies had to compete to get the best rigs.

Oversupply of rigs and vessels remains a major problem for the contractors. The OSV companies are even fighting over international charters, driving day rates slightly down in frontier markets like Guyana. I suspect more OSV management teams need to be absorbed/acquired to give the remaining players the pricing power to get back to profitability. Some vessel owners are continuing to fix term charters at just over OPEX costs, which fail to cover capital costs. Rigs rate have improved, but they are still not sustainable either; rigs and vessels can be bought at about half of their replacement value. The fight for survival is not over. We are still in the thick of it.

You can read the complete blog at IHS Markit, and also get daily access to market intelligence, vessel and contract data covering the global offshore supply vessel industry with Petrodata MarineBase.