The Bureau of Ocean Energy Management finalized four new offshore wind energy areas in the Gulf of Mexico on Oct. 27. Following a lackluster first-time Gulf lease sale Aug. 29, the agency and industry boosters hope to keep momentum going in the region.

“Creating an offshore wind industry in the Gulf of Mexico will take time and partnership. BOEM is pursuing another offshore wind lease sale in the Gulf of Mexico due to continued industry interest and feedback from our partners and key stakeholders,” said BOEM Director Elizabeth Klein in announcing the new areas.

In its initial Gulf of Mexico offerings, BOEM collaborated with NOAA’s National Centers for Coastal Ocean Science to build a model that analyzed the entire Gulf of Mexico ecosystem to identify and minimize potential conflicts with marine resources and ocean users. That led to the exclusion of some productive shrimp fishing areas from consideration, and the modeling process continued with the new wind energy areas.

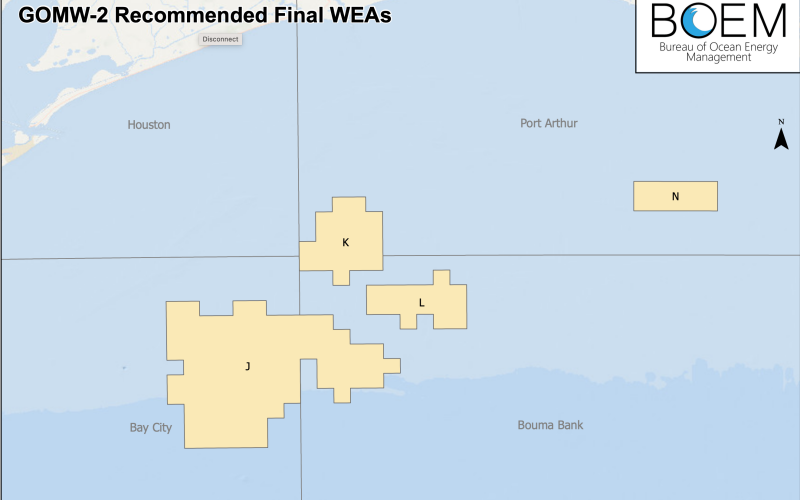

The four WEAs are, according to BOEM:

- Option J: 495,567 acres located approximately 47.2 miles off the coast of Texas, with the potential to support projects that could power 2.1 million homes.

- Option K: 119,635 acres located approximately 61.5 miles off the coast of Texas, with the potential to support projects that could power 508,200 homes.

- Option L: 91,157 acres located approximately 52.9 miles off the coast of Texas, with the potential to support projects that could power 387,450 homes.

- Option N: 56,978 acres located approximately 82 miles off the coast of Louisiana with the potential to support projects that could power approximately 242,000 homes.

“The projects hosted by these new areas could allow the Gulf of Mexico region to further solidify its position in the offshore wind industry, bringing even more opportunity to a region already heavily involved in the national supply chain,” said the industry nonprofit group Business Network for Offshore Wind.

“With nearly a quarter of U.S. market contracts going to Gulf firms, the area is already the engine for U.S. offshore wind industry; building a robust pipeline of projects will further unlock the true potential of the region’s supply chain capacity,” said John Begala, vice president of federal and state policy at the network.

The BOEM announcement came one day after a U.S. Senate Energy and Natural Resources Committee hearing on federal offshore energy strategy and policies. Committee chairman Sen. Joe Manchin, D-W.V., stressed the linkage between BOEM sales of offshore oil, gas and wind energy leases - a bargain he demanded as part of the federal Inflation Reduction Act that President Biden signed in August 2022. The law requires that new oil and gas leases go forward as a condition of BOEM planning new wind power areas.

Before that legislation came together, the Biden administration was heading toward no new offshore lease sales for oil and gas, Manchin said at the hearing Thursday.

Questioned by Manchin, BOEM Director Klein assured him the next lease sale is on schedule: “All systems are go for the sale on Nov. 8.”

“Before we passed the IRA, it was obvious that the Department of the Interior was slow walking the next five-year program while at the same time canceling already-scheduled lease sales,” said Manchin. “To address that, in the IRA we prohibited Interior from issuing wind and solar leases unless the Department also holds significant oil and gas lease sales, both on and offshore. As a result, Interior was forced to include oil and gas lease sales in their recently released 2024 to 2029 leasing program.”

“To be clear, the new five-year leasing program falls well short of what we should be doing by including only three oil and gas sales. This is barely a quarter of what the Obama administration approved for the last five-year program. But it’s clear we would have gotten exactly zero without the IRA,” he said.

Sen. Martin Heinrich, D-N.M., asked BOEM director Klein about progress on U.S. East Coast wind projects. The nascent industry is beset by escalating costs, and developers attempting to re-negotiate earlier power purchase agreements they say are no longer viable.

Klein said the Vineyard Wind project off southern Massachusetts, the first utility-scale project in federal waters, is “moving along as expeditiously as they can” amid some weather conditions.

She agreed with Heinrich’s observation that success of the first U.S. offshore projects can be “foundational” for showing the technology will work.