Imagine that one of your shipmates has decided to strike out on their own in the workboat business and finds a 65' Army tug from the 1950s for $200,000. Compared with the $3 million Z-drive tugs on the ship brokerage site, the outdated tug was a steal.

Your friend asks you to help inspect the tug to meet an insurance company’s seaworthiness requirements. Eager to help, you arrive at the shipyard with flashlight and clipboard. You plan to inspect everything related to the tug’s seaworthiness: steel thickness, corrosion, dried-out gaskets on watertight doors, shaft seals, and safety equipment.

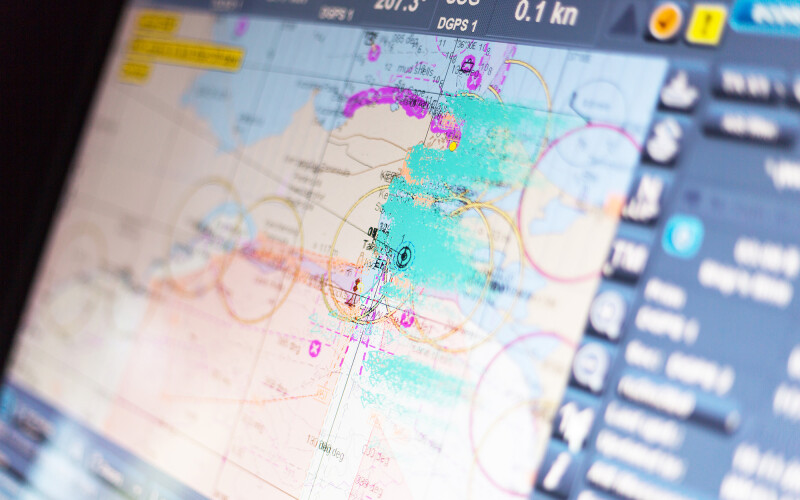

You might not direct your focus on the tug’s pilothouse. Electronic charts can wait for another day. This inspection is about seaworthiness, not navigation. Seaworthiness is about punching through nasty seas, not pinpointing your position with an electronic chart display.

But this view of seaworthiness might need updating as much as the software in this old tug’s electronic charts. In a recent case from the U.S. Court of Appeals for the First Circuit, a Massachusetts court dealt with this very issue. Here, a carrier argued that a vessel failed to satisfy the seaworthiness conditions of its insurance policy because of its charts.

The owner had planned to pick up the vessel in Grenada and sail to Aruba, and ultimately Sint Maarten. Unfortunately, the vessel ran aground off the Dominican Republic on a breakwater. The vessel’s insurance policy provided $365,000 in first-party property damage coverage for the waters of Florida, the Bahamas, and the Caribbean.

At the start of the voyage, the vessel had navigational charts for the intended Aruba-to-Sint Maarten route, which covered the Leeward Islands, Windward Islands, and Aruba. It also had a Garmin GPS and electronic charts for the Dominican Republic. However, the charts were outdated and did not show the breakwater.

The vessel owner argued that the charts it carried were adequate for its intended voyage. The insurance carrier argued that the vessel lacked up-to-date charts for the waters that the policy covered. The court ruled for the vessel owner. The case shows that seaworthiness isn’t merely about bow flare to deflect heavy seas. Seaworthiness can cover things like updates to navigational electronics.

Ref: Great Lakes Insurance SE v Andersson 23-1359, Appeal from the U.S. District Court for the District of Massachusetts.