As the largest tank barge operator along the inland river system, Houston-based Kirby Corp is normally associated with crude oil, petrochemicals and other things related to fossil fuels.

But times are changing and from what David Grzebinski said when releasing Kirby’s third quarter earnings report last week, the barge line is looking to mix it up, adding clean energy into its business mix.

What appears to be fueling this pivot is a combination of market and social changes that are putting pressure on companies to pay attention to the environment in ways that are also opening up new business opportunities.

The pandemic seems to be hastening this trend, as companies like Kirby are observing that their traditional customer base in chemicals and oil have experienced a huge “demand destruction” due to the economic fallout globally from Covid-19. This has made many worry about the long-term growth prospects for such industries.

For Kirby, this has encouraged a search for opportunities in what Grzebinski called “decarbonization” — the reduction of carbon emissions by using alternate energy sources like wind solar, hydro-electric and nuclear.

The trend toward ESG (Environmental, Social and Governance in which investors apply non-financial factors to evaluate risks and opportunities) and the decarbonization trend “is not only there, it’s gaining momentum,” he said in response to a question during the earnings conference call from Michael Webber of Webber Research and Advisory, which provides services to investors.

Grzebinski said Kirby is working with its major customers on these efforts and wants to determine “how we can do that in the inland space.”

While it will take a while for demand from the traditional customers to return, he predicted that the drive to curb carbon emissions will continue to affect demand for refined products.

“The bottom line is you’re still going to need energy in the world, as usage continues to grow as the underdeveloped world expands its living standards,” he said.

Kirby is already involved in carbon-reducing projects throughout the company, and for the past five years has been a market leader in building electric-powered fracturing units that reduce environmentally harmful nitrogen oxide emissions.

Kirby is also transporting more alternate fuels like methanol and ammonia, becoming a leader in that market as well, but he warned that this type of transportation is complex as ammonia is a highly dangerous product to carry.

Grzebinski noted that barging is already a highly environmentally friendly type of surface transportation, using less fuel with fewer emissions than other modes. “If you look at our carbon footprint per ton mile versus rail, we’re probably 25 percent better. And if you look at trucking, we’re probably on order of magnitude better in terms of moving product. So if anything, barging should be the mode of choice.”

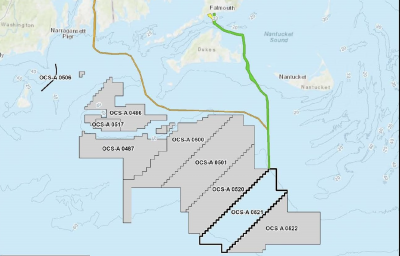

Kirby is also looking at opportunities “where our expertise in marine can support offshore wind.”

“So we’re looking at the changing world, and we’ve got lots of projects that can bring that forward for us and generate revenues.”

While companies like Kirby have taken a deep hit on the bottom line due to a decline in demand from Covid-19, the pandemic has also had an upside, prompting progressive and innovative discussions in the board room.