Pipelines and other midstream components hold pivotal, if largely unheralded roles in the ambitious objective of eventually ridding the world of greenhouse gas (GHS) emissions, especially when it comes to carbon capture and storage initiatives, according to Wood Mackenzie.

“Midstream companies are well-placed to play a significant role in the full carbon capture, utilization and storage (CCUS) value chain,” said Rachel Schelble, the consultancy’s head of corporate carbon management and infrastructure. “First and foremost, operators can capture carbon dioxide (CO2) at their own facilities. Firms can also employ their expertise to build, own and operate greenfield infrastructure. And by developing sequestration partnerships they can ensure captured carbon is either used or stored permanently.”

The oil and gas community has embraced CCUS as a means of capturing and permanently burying, or otherwise storing, noxious emissions before they enter the atmosphere, thereby enabling the future use of fossil fuels amid a growing clamor to transition to renewable energy sources. Driven by North America and Europe, Rystad Energy projects global spending on carbon capture and storage will quadruple to $50 billion by 2025, up from $4.4 billion in 2022. Of the 84 commercial developments announced, 63 will be in those two regions. The U.S. Department of Energy (DOE) has identified decommissioned Gulf of Mexico oil and gas wells as attractive CO2 burial grounds.

Gulf of Mexico operator Talos Energy Inc. said on Feb. 25 that it intends to file permit applications “for several carbon capture projects this year” along the Texas and Louisiana coasts. In January, Talos and Freeport LNG Development LP teamed up in a plan to bury CO2 in a dedicated wellbore in Texas state waters, adjacent to the latter’s LNG pretreatment facility in Freeport, Texas. Injections are forecast to begin in 2024.

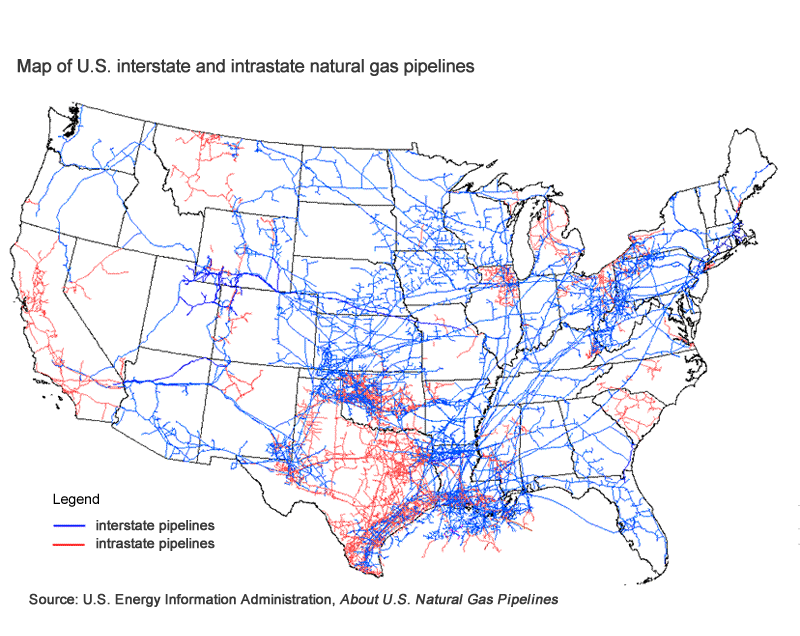

In February, Talos signed a preliminary agreement with pipeline operator EnLink Midstream to pursue carbon transportation and sequestration in Louisiana. Repurposing oil and gas pipelines to transport CO2, however, will require some major tweaking, said Schelble.

“Carbon dioxide needs to be transported at pipeline pressures between 1,200 and 2,200 psi. With crude pipelines operating at 600 psi to 1,000 psi and natural gas pipeline pressures ranging from 500 psi to 1,400 psi, significant upgrading may be needed,” she said.

Nevertheless, “Several projects and collaborations are already in the works," said Schelble, pointing specifically to carbon sequestration partnerships involving pipeliners Williams Companies, Enbridge Inc., Enterprise Product Partners LP, as well as EnLink. “Williams is capturing emissions at its plants and facilities, for example,” Schelble said.