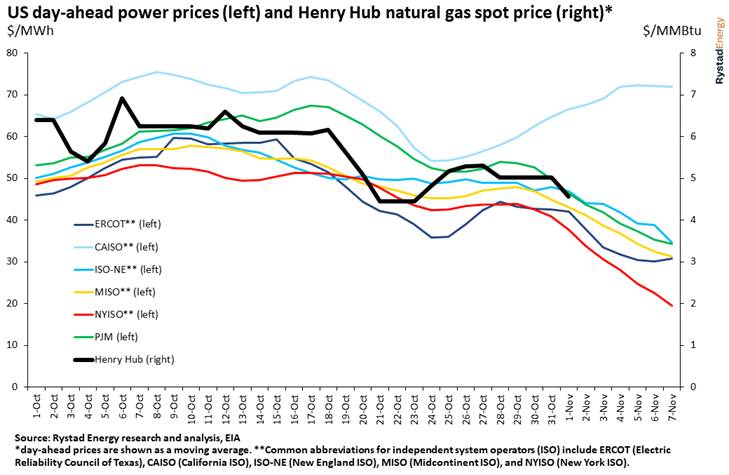

Power prices across the U.S. continued to drop last week, with some regions averaging more than 20% below the previous week’s price.

The average power price across observed markets in the first week of November was $42.06 per MWh, a $6.40 drop from the last week of October.

National power prices have been falling for four weeks straight, corresponding to falling gas prices and decreased demand.

New York power prices had the sharpest two-week power price decline, falling by an average of 30% to $30.54 per MWh. California was an exception for the U.S., being the only observed region of the previous week to have increased prices to an average of $69.02 per MWh.

Observed markets in the eastern U.S. all followed a downward trend in prices, likely corresponding to the recent fall of the Henry Hub natural gas price.

The tie between October’s power prices and the Henry Hub natural gas price can be observed below

The western U.S. price increases last week were due to heavy snow that started on 31 October through much of the northwest.

The snow caused an increase in electricity demand of about 3% in the northwest and 1% in California.

Winter weather is expected to move into the eastern U.S. within the month.

The expectation of a cold winter has increased Henry Hub December futures from about $6 per million British thermal units (MMBtu), recorded on Nov. 3 to over $7 per MMBtu, recorded on Nov. 7.

Hydroelectric power generation rose by 12% to cover the higher demand in the western U.S.

The heavy snow brought more hydropower potential and higher prices – a strong incentive for hydroelectric plants to produce more power.

Generation from solar PV fell 16% across the U.S., corresponding to the incoming winter season.