Fallout from Ørsted’s decision to abandon its Ocean Wind 1 and 2 projects off New Jersey continues to reverberate through the fledging U.S. offshore wind industry and its political and environmental support system.

In an earnings call Wednesday, Ørsted CEO Mads Nipper explained the rationale for pulling out of a flagship project for U.S. waters.

“These are obviously some very tough decisions,” said Nipper, whose company earlier shook the industry with its warning of a $2.3 billion write-down in diminished value.

With its decision to axe the 1,100-megawatt Ocean Wind 1 project and its follow-on phase, that write-off swells to $5.6 billion. But the business case for continuing to pursue the projects “was worse than we had on our books,” said Nipper.

In terms of damage control, Ocean Wind was “75% of the impairment we were looking at,” said Nipper. The project was facing “further significant delays” in getting equipment, and vessels for installation, which would lead to a “multi-year delay” forcing Ørsted to re-negotiate with suppliers, he said.

The surprise announcement on Halloween around 7:30 p.m. East Coast time triggered an uproar among New Jersey politicians. Democratic lawmakers allied with Gov. Phil Murphy had hastily pushed through a budget package June 30 to allot more federal renewable energy tax credits – estimated to be worth as much as $1 billion – to Ørsted in hopes of heading off such a crisis.

With the that close collaboration shattered, Murphy said state officials will extract all penalties they can against the developers.

“Today’s decision by Orsted to abandon its commitments to New Jersey is outrageous and calls into question the company’s credibility and competence,” according to a statement from Murphy. “As recently as several weeks ago, the company made public statements regarding the viability and progress of the Ocean Wind 1 project. In recognition of the challenges inherent in large and complex projects, my Administration in partnership with legislative leadership insisted upon important protections that ensure New Jersey will receive $300 million to support the offshore wind sector should Orsted’s New Jersey projects fail to proceed.”

“I have directed my Administration to review all legal rights and remedies and to take all necessary steps to ensure that Orsted fully and immediately honors its obligations.”

Yet Murphy insisted New Jersey will press on with its renewable energy ambitions:

“In recent weeks we’ve seen a historically high number of bids into New Jersey’s ongoing third offshore wind solicitation, and the Board of Public Utilities will shortly announce two additional solicitations related to our first-in-the-nation State Agreement Approach to build an offshore wind transmission infrastructure. I remain committed to ensuring that New Jersey becomes a global leader in offshore wind – which is critical to our economic, environmental, and clean energy future.”

Republican officials who battled the Murphy administration’s wind power plans for months hailed the unexpected decision by Ørsted.

"These Green New Deal style wind farms were bad for our economy, our environment, and would have been a complete disaster for hardworking middle-class families in South Jersey," said Rep. Jeff Van Drew, R-NJ, whose southern New Jersey district would be the landfall for Ocean Wind power cables.

"From the beginning, these projects were all about lining the pockets of foreign-owned offshore wind companies. Orsted repeatedly asked for additional taxpayer funds and tax breaks, while expecting ratepayers to absorb a massive increase in utility costs,” said Van Drew.

While wind project critics exulted, environmental advocates were defiant.

“Let’s be clear: clean energy advocates are not defeated by this outcome, as it has nothing to do with the local, astroturfing opposition groups in New Jersey or the fossil fuel industry. This setback is financial,” said Anjuli Ramos-Busot, director of the Sierra Club’s New Jersey chapter.

“We are eager for the third round of solicitations and see this just as a setback in our timeline, not an end to our goals of cleaner air, family-sustaining jobs, and transitioning away from fossil fuels," said Ramos-Busot.

Officials in Cape May County, N.J., claimed some credit for Ørsted’s retreat with their political opposition and court challenges to the company, state utility and environmental regulators and the federal Bureau of Ocean Energy Management.

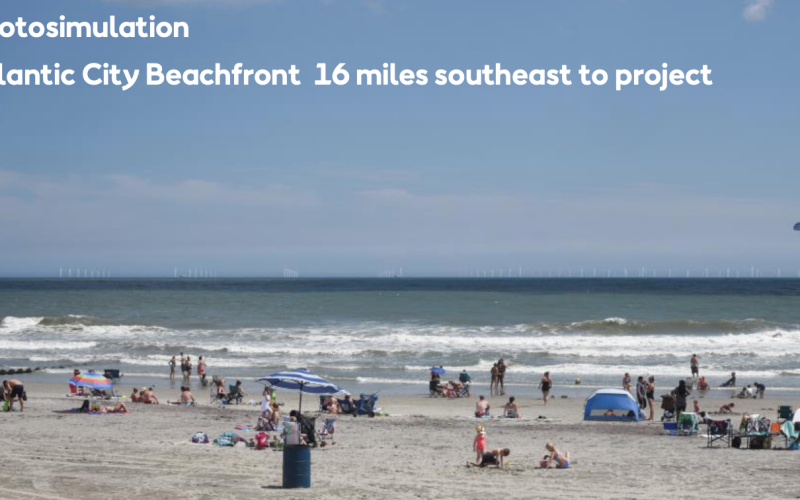

The critical trigger for opposition was a study of the potential visual impact of wind turbines from Cape May beach resorts, that estimated the county’s big tourism industry could see a fall-off of 15 percent in visitors, said Len Desiderio, director of the county Board of Commissioners in a Wednesday morning press conference.

Alongside tourism was a concern for the region’s commercial fishing industry. One estimate by Rutgers University researchers found that 25% of annual surf clam landings at Atlantic City could be lost and county officials saw “thousands of acres of our ocean floor that would be destroyed,” said Michael J. Donahue, the county special counsel for offshore wind.

“That’s why we said we won’t be part of this reckless experiment,” said Donahue.

But county officials noted that Ørsted’s wind energy leases from BOEM could be transferable to another developer.

“From a very basic position, the leases are still there,” said Donahue.

During the earnings call, Nipper said power export cables and other existing equipment could be recovered and sold as part of the project “breakaway costs.” Offshore wind advocates clearly hope that other developers will step in with New Jersey’s next solicitation round.

“New Jersey remains a market leader and will continue emerging as a hub of manufacturing, logistics, and development for the industry,” said Sam Salustro, vice president of strategic communication at Oceantic Network, the recently re-branded name of the Business Network for Offshore Wind. “We are encouraged by the Governor’s resolute commitment to building a robust industry and look forward to the results of the state’s third solicitation round.”

In another statement late Wednesday, Oceantic CEO Liz Burdock laid out what the group sees as still-promising signs:

- “The U.S. has 37 commercial-scale projects under development. In fact, the same day as the Ørsted announcement, Dominion Energy received its Record of Decision from the Bureau of Ocean Energy Management for the 2.6 GW Coastal Virginia Offshore Wind project and is moving forward with construction. Off the coast of New England, two commercial scale projects - including Ørsted’s South Fork Wind - are deep into installation.”

- “On the same investor call yesterday, Ørsted announced it took the Final Investment Decision for its 704 MW Revolution Wind project powering Connecticut and Rhode Island, paving the way for installation to begin. Ørsted also noted it would continue evaluating its remaining portfolio – the Sunrise Wind and Skipjack projects in New York and Maryland, respectively.”

- “Long-term demand for offshore wind in the U.S. is not abating – instead, it continues growing. State demand for offshore wind exceeds 80 GW and states like Connecticut and Rhode Island have only grown their overall market targets in recent months. Over the summer, Maine passed a new 3 GW goal and California continued putting the pieces together for their emerging market.”