The Bureau of Ocean Energy Management announced Sept. 11 that it has completed an environmental review of Empire Wind, two offshore wind projects being developed by partners Equinor and BP near the New York Harbor approaches.

BOEM’s announcement follows on news that Equinor and BP are seeking a major increase in their New York contract prices for the 2,076-megawatt Empire Wind I and II phases, plus their Beacon Wind project.

"Application of Empire/Beacon's request would result in a 54% increase on average across its portfolio of projects," according to a document filed with regulators at the New York Public Service Commission by the New York State Energy Research and Development Authority.

According to NYSERDA’s filing, the “strike price” for Empire Wind 1 would rise from $118.38 per megawatt-hour (MWh) to $159.64/MWh and for Empire Wind 2 from $107.50/MWh to $177.84/MWh. Beacon Wind would see the strike price rise from 118.00/MWh to 190.82/MWh.

Meanwhile for their Sunrise Wind project, developers Ørsted and Eversource are looking for a 27% step-up, from $110.37/MWh to $139.99/MWh.

NYSERDA said developers “cite an unexpected and unforeseeable rise in inflation and supply chain costs and constraints associated with, among other things, the Covid-19 pandemic and the Russian invasion of Ukraine.” As a result, the authority says, projects now in development are “no longer be economically viable under existing contract pricing terms.”

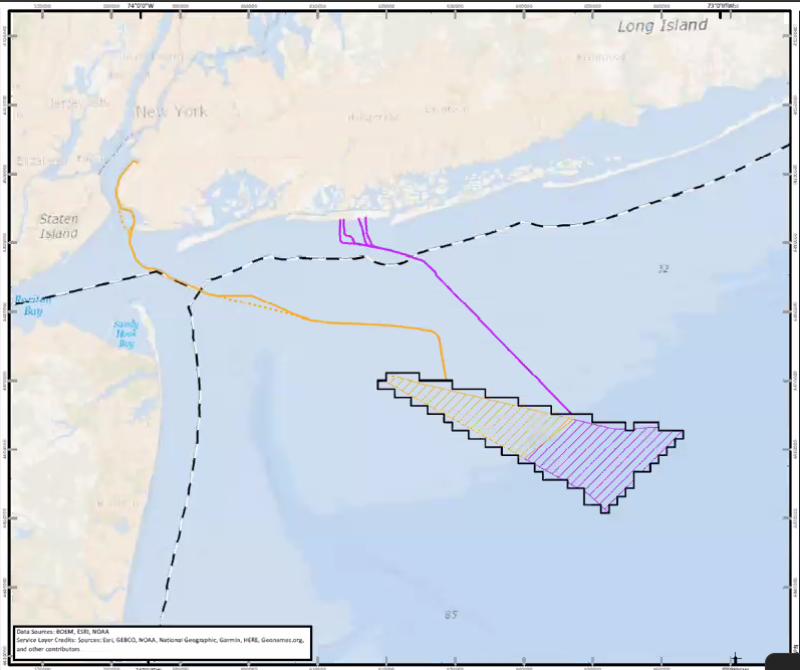

Empire Wind, LLC proposes Empire Wind 1 and Empire Wind 2 on its lease area about 12 nautical miles south of Long Island, New York, and about 16.9 nm east of Long Branch, N.J. Empire Wind 1 would be equipped with up to 57 wind turbines, with up to 90 planned on Empire Wind 2.

The arrays would operate independently with two offshore substations and two export cable routes connecting to the onshore electrical grid on Long Island.

BOEM officials said the agency’s Notice of Availability will publish in the Federal Register on Sept. 15 for a proposed project’s final Environmental Impact Statement (EIS), to be available The final on BOEM’s website.

BOEM’s announcement was greeted with approval by Josh Kaplowitz, vice president for offshore wind with the American Clean Power Association, who said BOEM’s final record of decision approving Empire Wind is expected this fall.

“We’re pleased to see ongoing progress at BOEM in advancing offshore wind projects as part of a clean energy future,” Kaplowitz said in a prepared statement. “Empire Wind’s two phases will send more than two gigawatts (GW) of clean, reliable, and homegrown wind energy directly into the largest metropolitan area in the U.S. and will power a million New York homes.”

That bit of good news for wind power boosters could be overshadowed by the industry’s mounting financial challenges. Months before NYSERDA’s analysis of developers’ new pricing requests, Massachusetts utility regulators heard from developers seeking to withdraw from previous agreements and re-bid.

The industry was rattled in recent weeks when Ørsted indicated it may take a $2.3 billion write-down on the value of its U.S. offshore wind projects. To keep Ørsted’s Ocean Wind 1 project viable off New Jersey, Democratic state legislators approved steering another $200 million in federal renewable energy tax credits to the company during last-minute budget negotiations June 30.