Shell plc is withdrawing from the Atlantic Shores wind project of New Jersey, writing off nearly $1 billion as the energy major retreats from its earlier pivot toward renewables.

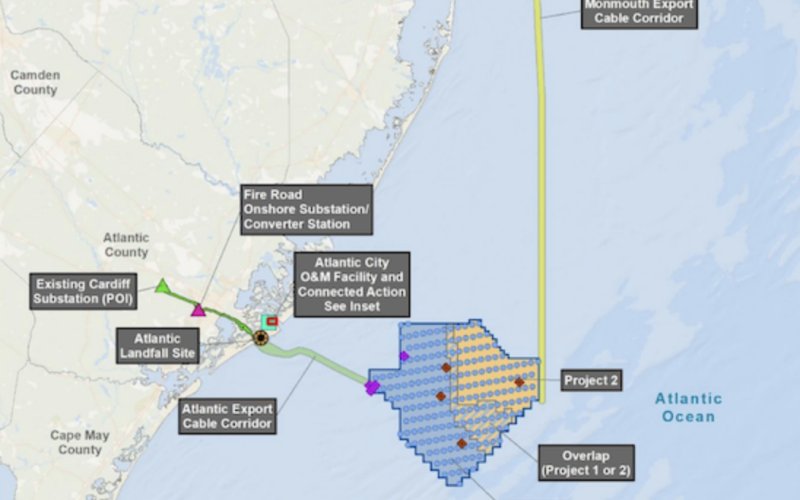

In its quarterly earnings report on Jan. 30, Shell disclosed a $996 million impairment associated with Atlantic Shores, planned as a 2,800-megawatt array of 197 turbines off Long Beach Island and Brigantine, N.J.

“We just don’t see that it fits both our capabilities nor the returns that we would like,” Sinead Gorman, Shell’s chief financial officer, said in a call with reporters Bloomberg reported. “So we took the decision to effectively write that off and pause our involvement.”

The announcement came amid continuing economic challenges to U.S. offshore wind developers – and now political pressure from a hostile Trump administration. The joint venture by Shell New Energies US LLC and EDF-RE Offshore Development, LLC was targeted by anti-wind power groups and Rep. Jeff Van Drew, who worked with President Donald Trump’s administration officials to draft the Jan. 20 executive order for a six-month delay of permitting.

Despite Shell’s morning announcement, Atlantic Shores management later put out a brief statement saying the venture “is committed to New Jersey and delivering the Garden State’s first offshore wind project.”

“While we can’t comment on the views of shareholders, Atlantic Shores intends to continue progressing New Jersey’s first offshore wind project and our portfolio in compliance with our obligations to local, state and federal partners under existing leases and relevant permits,” the statement added.

The statement gave no indication as to whether EDF might seek a new joint venture partner. Even if stalled the Atlantic Shores backers still have the federal lease rights for potential future development.

The Bureau of Ocean Energy Management approved the Atlantic Shores construction and operations plan Sept. 30, amid a flurry of actions under the Biden administration to advance wind projects. In February 2022 Shell was a participant in BOEM’s record-setting $4.37 billion New York Bight wind leases auction, a high point in the Biden era rush by developers optimistic about their U.S. prospects.

Within two years, the industry faced mounting pressures from inflation, mounting costs, and supply chain problems. In autumn 2023, industry leader Ørsted suddenly announced it was giving up on its Ocean Wind project off New Jersey, a planned 1,100 MW project that had been a centerpiece of state officials’ ambitions for renewable energy.

In the meantime, Shell CEO Wael Sawan began pulling back from the company’s earlier shifts toward renewables and moved to concentrate on the better returns from Shell’s legacy oil and gas business.