In a flurry of actions offshore wind developers traded joint ventures off New York for sole ownership, rebid into the state’s latest solicitation, and withdrew from previous agreements with Maryland – the latest in industry retrenchment.

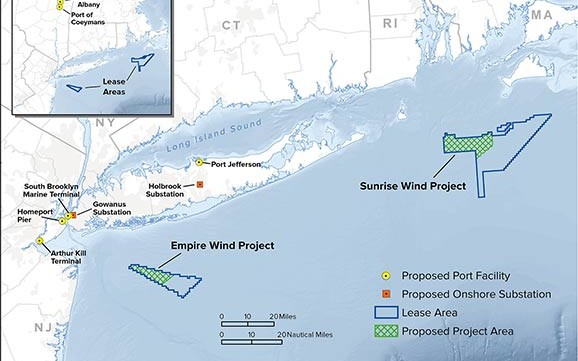

Equinor and bp announced Thursday they will split their joint ventures, with Equinor taking full ownership of the Empire Wind 1 and 2 projects, and bp assuming full ownership of the Beacon Wind project. Equinor said it is rebidding the 810-megawatt Empire Wind 1 project into New York’s fourth solicitation

Joint venture partners Ørsted and Eversource likewise are rebidding their Sunrise Wind proposal, months after New York utilities regulators rejected all the companies’ requests to re-negotiate existing power purchase agreements.

In Maryland, state officials and Ørsted agreed to terminate agreements for the Skipjack 1 and 2 projects, with an eye toward “future offtake opportunities.”

The moves are part of developers’ and state energy planners’ attempt to recover from widespread turmoil when it became clear that power purchase deals were not financially viable amid global economic pressures despite subsidies.

“A mutual termination agreement has also been reached with the New York State Energy Research and Development Authority (NYSERDA) for the Beacon Wind 1 Offshore Wind Renewable Energy Certificate (OREC) Purchase and Sale Agreement,” the Thursday announcement from Equinor noted. “Earlier this month, Empire Wind 2 agreed to cancel its OREC agreement as part of a strategic reset due to macroeconomic factors that have had an industrywide impact.”

Already several years into development, Empire Wind’s contribution to New York’s wind power infrastructure will remain redeveloping the South Brooklyn Marine Terminal as a future hub for East Coast offshore wind. Equinor is taking on bp’s 50% ownership of SBMT as well.

“Empire Wind 1 is ready and so is Equinor,” said Molly Morris, President of Equinor Renewables Americas. “New York has demonstrated its commitment to offshore wind and this project will play a foundational role in driving that commitment forward.”

Empire Wind 1 “is in a clear position to move forward” with a new bid to New York energy planners, “while Empire Wind 2 will be further matured for future solicitation rounds,” according to Equinor.

Meanwhile bp officials offered few specifics about the future of Beacon Wind, other than at some point they could pursue a new Offshore Wind Renewable Energy Certificate (OREC) Purchase and Sale Agreement for the Beacon Wind 1 project.

“Beacon Wind 1 and 2 have immense potential to create American jobs, benefit local communities, deliver low carbon energy and support the energy transition,” said Joshua Weinstein, bp’s president of offshore wind Americas. “bp has a proven track record of delivering complex engineering projects offshore, and we’ll continue bringing that expertise to bear as we advance the development, engage with communities and bring these projects closer to commercial operations."

The Empire Wind and Beacon Wind pullbacks were fallout from the inflationary wave, supply chain issues and interest rate costs that swamped U.S. wind developers, most notoriously when Ørsted suddenly announced Oct. 31 it was dropping out of its Ocean Wind project agreement with New Jersey.

Ørsted and joint venture partner Eversource joined in the New York solicitation this week, submitting a new proposal for Sunrise Wind and its potential 924 MW capacity. But the bid could presage another consolidation, with Ørsted taking full ownership if New York accepts the bid.

“In advancing the re-bid for Sunrise Wind, the joint venture reached an agreement for Ørsted to acquire Eversource’s 50% share in the project if it is awarded a contract in New York’s fourth offshore wind solicitation,” according to a summary by the companies.

“In a successful re-bid, Ørsted would become the sole owner of Sunrise Wind, while Eversource would remain contracted to lead the project’s onshore construction. Should Sunrise Wind be successful in the re-bid, Ørsted would pay 50% of the negotiated purchase price upon closing the sales transaction, with the remaining 50% paid when onshore construction is completed and certain other milestones are achieved.”

If New York officials do not selected the Sunrise bid, the joint venture will remain in place, and “Ørsted and Eversource would then assess their options in determining the best path forward for Sunrise Wind and its assets.”

“As the most mature offshore wind project in the state’s pipeline, Sunrise Wind is expected to be completed in 2026, helping the state achieve its mandate of 70% renewable energy by 2030, while paving the way for future state projects and accelerating the state’s growing offshore wind workforce and supply chain,” according to an Ørsted statement.

“Sunrise Wind is ready-to-build and ready to make more historic investments in New York’s offshore wind economy, creating jobs and delivering economic benefits immediately,” said David Hardy, group executive vice president and CEO Americas at Ørsted. “We’re already leading the way with our trailblazing South Fork Wind project. Sunrise Wind will build on the promise of offshore wind for New York, including hundreds more local union jobs and investments in a statewide supply chain, while delivering major progress toward New York’s clean energy targets.”

At the same time, Ørsted announced it would “reposition Skipjack Wind, a combined 966-megawatt project in development off the coast of the Delmarva peninsula, for future offtake opportunities.”

Renewable energy credits under earlier agreements with Maryland “are no longer commercially viable because of today’s challenging market conditions, including inflation, high interest rates and supply chain constraints,” the company said.

Hardy cast the decision as “an opportunity to reposition Skipjack Wind, located in a strategically valuable federal lease area and with a state that is highly supportive of offshore wind, for future offtake opportunities.”