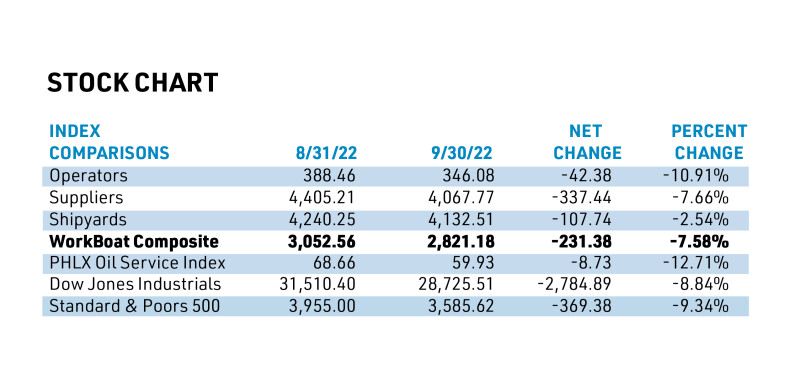

In September, the WorkBoat Stock Index lost 231 points or 7.6%. For the month, losers topped winners by an 11-1 ratio.

The top percentage loser for the month was Transocean Ltd., which saw its shares drop 32% in September. The offshore drilling contractor’s shares have felt the heat from the drop in oil prices. WTI oil prices, which were about $122 bbl. in early June, closed at $77.17 bbl. on Sept. 30. The company has also been affected by the broader stock market, which is being dragged down by hawkish central bankers who want to continue to tighten monetary policy to reduce inflation and growth.

But in Transocean’s second-quarter earnings call in August, CEO Jeremy Thigpen was optimistic. “While we have experienced volatility, commodity prices have remained within a range that is still extremely healthy for offshore development,” he told analysts. “Indeed, the outlook for our industry-leading assets and services are the most promising it has been in many, many years.”

Thigpen said that the long-term replacement of hydrocarbon reserves have consistently fallen short of production levels. “This consistent shortfall in production leads us to conclude that we’re in the early stages of a sustainable recovery.”

Thigpen said Transocean believes “the case is clear that E&P companies will continue to engage in exploration and development work to meet worldwide demand and replenish diminishing reserves.”