It’s been nearly a week since the semi-annual OPEC gathering where oil ministers define their pricing strategy for the oil market going forward.

The meeting’s agenda was to determine what level OPEC’s output should be set at in 2018 in order to ensure that the oil market rebalancing would continue. A rebalanced oil market, coupled with accelerating oil demand, would boost global oil prices and translate into more income for oil exporters, something most of them desperately need. The challenge for the oil ministers at the meeting was to figure out just how high they could push oil prices before non-OPEC supply surges and/or global oil demand begins falling. Either condition, or a combination of, could undermine OPEC’s pricing strategy.

The key to the OPEC deal coming together was Russia’s continued commitment to keep its output restricted. In return for Russia’s support, OPEC agreed to reassess the health of the global oil market immediately before its June 2018 meeting. Russia has been particularly sensitive to sharply higher oil prices bringing too much American oil shale supply into the market. The Russian economy has improved over the past year, so much so that it is no longer as dependent on significantly higher oil prices to support it.

While most eyes are on U.S. horizontal drilling rig count growth as a measure of what will occur with shale oil output, the health of the offshore business is slowly improving. Major oil companies continue making progress in lowering offshore field breakeven prices, which will enable more projects to receive final investment approval.

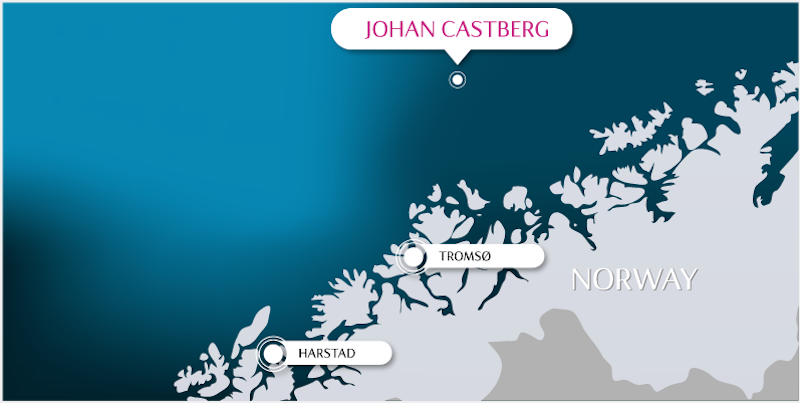

Earlier this week, Norway’s Statoil ASA approved its flagship Johan Castberg Arctic oil project. By eliminating the need for an onshore oil terminal and other redesigns, along with reduced supplier prices, the project’s breakeven price was cut from more than $80 bbl. to below $35. That means Statoil will only need to spend about 49 billion kroner (about $6 billion US), rather than its prior estimate that the Barents Sea project would cost 100 billion kroner. Target start-up date for the field is 2022.

To put into a proper perspective the significance of this announcement, Castberg is estimated to hold between 400 million to 650 million bbls. of crude oil. The Barents Sea is estimated to hold about half of Norway’s undiscovered oil and gas reserves, which have become increasingly more important since the country’s crude oil output has fallen by half since 2000, putting pressure on the government to get more exploration going in the region.

While overall offshore drilling rig fleet activity appears to be treading water, the magnitude of progress in reducing field development projects, such as shown with the Castberg field development, has been significant, and will be a positive for boosting future activity. After OPEC signaled it would work to achieve higher oil prices in 2018, albeit not too high, the offshore industry is answering that it can cut breakeven costs, even in one of the most expensive regions of the world. That message should be taken as a positive signal that a recovery in offshore drilling rig activity is underway.