Everything that occurs underwater requires a boat topside, but the connection between vessel operators and subsea service providers is one that continues to evolve.

Smaller workboat platforms are emerging as powerful contenders in mission completion operations. What specific technologies and innovations are driving this transformation? Should a vessel operator be in the business of delivering a mission service or as a mission service enabler? These are some of the questions that were explored and answered during the "Connecting the Present & Future of Vessel Operators & Subsea Services" at the International Workboat Show.

Moderated by Bob Christ, CEO of SeaTrepid International, the discussion began with a simple question about whether or not a vessel should be considered an ROV boat or a boat with ROV. The answer to that question needs to be determined by the primary contractor. In addition, what is the downtime? And who gets the primary reward?

“There’s no right or wrong. It’s a business strategy question,” said Christ, whose company is an offshore robotics services company servicing major industrial clients worldwide. “The person with the most risk has the most reward, so who eats the cost if something goes wrong?”

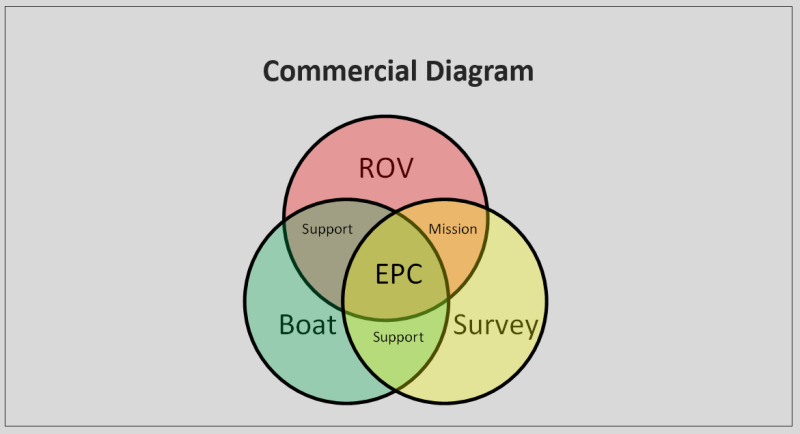

Christ showed slides that highlighted the crossover between ROV, survey, and boat interests, illustrating where the crossover exists with support and mission specifics.

“The risk needs to end up in the right bucket,” said Carl Annessa, executive vice president at Hornbeck Offshore Services Inc.

Hornback integrated ROVs into its boats years ago, and that integration helped sell those boats. However, it takes a lot of money to get the ROV integrated, which made vessels that were targeted for deep water especially suited for the job. The fits and needs go beyond these types of specific vessels though.

“The market is going to be different, and the specifics depend on what’s driving those answers,” said David Sheetz, who as vice president, is responsible for overseeing and managing C-Innovation’s Subsea Projects Group in Houston. “The driver for us to get into services was increased vessel utilization, but now it has become a leader in the group. Now it stands on its own.”

The opposite has happened with Hornbeck though, as they’ve stopped doing this type of integration, for multiple reasons. Ultimately, the numbers and models have to make sense, and it’s easy enough to see when things aren’t right with either.

“You don’t want a five-million-dollar tail wagging a 150-million-dollar dog,” said Christ, in reference to the cost of ROV integration being so much less than the overall vessel cost.

The three also discussed what it has meant to encourage clients to contract ROV services separately, how they’re in the problem solving, not problem-having, business, the value associated with short term versus long term contracts, and the importance of having the right personnel.

“ROVs are the people,” said Sheetz. “If you’ve got kids, get them into that industry. You’re putting a person in charge of a seven-million-dollar asset. If you look across the sector, there are half the people doing as much work, if not more, so the need and demand are real.”