In today’s world just having hull and protection and indemnity insurance may not be enough.

Does your vessel have tenders? While your hull’s coverage extends to the tenders and launches, they will also have the same deductible that your vessel carries. This could often be higher than the value of your tender. By listing your tenders separately, you can have them insured for a stated value and have a much lower deductible for them. And don’t forget to inform your agent if you install a new outboard on your tender. You won’t have increased coverage for it unless you notify the insurance company.

Pollution is excluded from all hull and P&I policies. There is some buy-back coverage available, but it is limited and often still will not respond when needed. A standalone pollution policy provides wide ranging coverage for not only clean up but also fines, penalties and potential liability. And don’t forget that there is more to pollution besides petroleum spills. Black-water and chemical spills can be just as damaging and costly.

Your vessel is often your sole means of making money. If your boat is not operating, you are losing income. If “loss of income” is added to your policy, it is a way to maintain a source of revenue while your boat is being repaired due to a covered claim. Coverage for loss of income is based on the amount you want. The more coverage the higher the premium. The big thing to remember is that loss of income is not triggered unless your vessel suffers a claim that is covered.

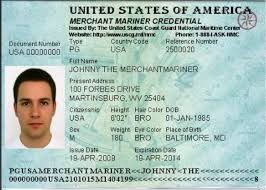

As a vessel operator your merchant mariners license can be as important to you as the vessel you operate. Without your license you cannot operate a commercial vessel. Insurance coverage for your license can be important if you are in an admiralty hearing. Coverages are wide ranging, and limits can vary.

Insurance is never one-size-fits-all. Coverages vary depending on what you ask for and the limits that you and your business desire.