With summer’s end, the relentless boosterism behind U.S. offshore wind development received a splash of cold water to the face as developers looked at their financial numbers.

Escalating costs for steel and other materials along with interest rates already had European wind turbine manufacturers warning that they were losing money in spring 2022. Then last summer Dominion Wind, developers of the 2.6-gigawatt Coastal Virginia Offshore Wind project, warned that state officials’ demand for a power performance guarantee could kill the largest U.S. project.

Dominion had estimated its turbines would perform on average at 42% of the maximum nameplate capacity of the wind generators. Dominion appealed the guarantee holding it to that performance and asking for more flexibility. In a Sept. 29 filing with Virginia state officials, Dominion said keeping the guarantee “will prevent the project from moving forward and the company will be forced to terminate all development and construction activities.”

A month after the $9.8 billion project seemed at dire risk, Dominion and Virginia Attorney General Jason Miyares announced a settlement plan on Oct. 28.

“This hard-fought agreement includes unprecedented consumer protections for Virginians,” said Miyares. “Traditionally, Virginia consumers have paid for all of the costs of utility projects. Today’s agreement changes that in the event of cost overruns. Dominion Energy has agreed to cost sharing and a cost cap on construction expenses, after which it will be responsible for all cost overruns. The agreement also includes a performance standard designed to ensure that the project produces the energy promised.”

Instead of the hard performance minimum guarantee the commission originally called for Aug. 5, Dominion said the settlement poses an alternative, requiring detailed reporting on turbine performance.

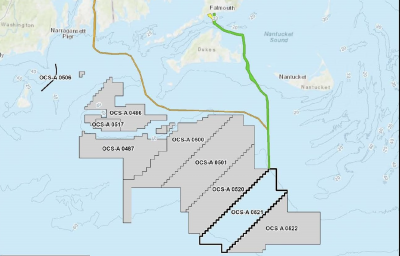

The pricing anxiety struck next in Massachusetts, when Avangrid sought to renegotiate its power purchase agreement (PPA) for the Commonwealth wind project with state utilities, as did Mayflower Wind, a venture by Shell New Energies US LLC and Ocean Winds North America.

“Global commodity price increases, in part due to ongoing war in Ukraine, sharp and sudden increases in interest rates, prolonged supply chain constraints, and persistent inflation have significantly increased the expected cost of constructing the project,” according to Avangrid. “As a result, the project is no longer viable and would not be able to move forward absent amendments” to power purchase agreements, the company said.

After tense negotiations, Massachusetts state officials and power companies were keeping the PPAs in place, with an agreement to continue talking with developers about their supply chain problems and global industry issues.