The maritime industry will find a friendly environment in Congress and at the White House as a result of last week’s elections, but it should brace for some major policy shifts as a Biden administration pushes ahead with its promised climate change agenda.

Maritime stakeholders can expect strong support in the White House for the Jones Act, which the industry considers crucial to its future as the law reserves coastwise trade for U.S. built, owned and crewed vessels. Biden included the Jones Act as part of his economic platform, and personally assured maritime unions of his support during the campaign.

“We know President-elect Biden is a very strong supporter of the Jones Act and the U.S.-flag fleet,” Michael Sacco, president of the Marine Trades Department at the AFL-CIO, said in a statement after the election. “Vice President-elect Harris also has demonstrated her total support for the U.S. merchant marine while representing California in the U.S. Senate.”

In Congress, the number of pro-maritime lawmakers did not change significantly. Voters returned to office the majority of the industry’s strongest supporters who serve on committees that oversee maritime issues and funding, and who often speak publicly favoring the Jones Act.

“We're looking at a 97% retention rate for all lawmakers we supported in the 2020 election cycle,” said Craig Montesano, vice president, legislative affairs at the American Waterways Operators, which represents the tug, towboat and barge industry.

Topping the list in the House, where Democrats will retain power, are Reps. Peter DeFazio, chairman of the House Transportation and Infrastructure Committee and Sean Patrick Maloney, D-NY, chair of that panel’s Coast Guard and Maritime Transportation subcommittee, as well as key members of the House appropriations committee.

DeFazio and his committee are trying to secure additional funding for the maritime industry, which was largely left out of the first Covid-19 relief bill. Work is underway on the Maritime Transportation System Emergency Relief Act, which is included in the National Defense Authorization Act. That bill has been passed by the House and Senate and a final agreement could come during the lame duck session.

In the Senate, where the majority party won’t be determined until after two run-off elections in Georgia, maritime stakeholders are also pleased with election results. They cite the re-election of Sens. Roger Wicker, R-MS, chair of the Senate Commerce Committee, which oversees maritime matters, Dan Sullivan, R-AK, and Susan Collins, R-Maine, who had a tough re-election challenge and has used her seat on the Senate Appropriations Committee to boost the industry, most notably training at the Maine Maritime Academy and shipbuilding at Bath Iron Works.

The industry will likely continue to have the bipartisan support that it has enjoyed over the years in Washington, since action on maritime policy and fiscal priorities do not generally fall along party lines.

As Biden begins to consider his cabinet positions, his selections for the Transportation, Agriculture and Energy departments and the Environmental Protection Agency will be important to the maritime industry. Although no firm decisions have been announced, under consideration for DOT are Los Angeles Mayor Eric Garcetti, a Biden loyalist, Rep. Earl Blumenauer, D-OR, who has been active on transit policy, and Beth Osborne, director of a transportation advisory group who was a deputy assistant secretary for transportation during the Obama administration. Biden has signaled that improving infrastructure is a priority for him, and that transportation initiatives will include measures to decrease carbon emissions.

The current DOT Secretary is Elaine Chao, who is also the wife of Senate Majority Leader Mitch McConnell. Chao’s family is in the shipping business and she has been a strong advocate of the Jones Act as well as marine highway and ports funding. It’s not yet clear if any of her possible successors have direct ties or deep knowledge of the maritime community.

On shipbuilding, the Biden administration will inherit the National Security Multi-Mission Vessel program, which began under President Trump and would build the next generation of training vessels for state maritime academies that would also be used during national emergencies like hurricanes. Philly Shipyard has been awarded the contract to construct up to five ships.

Under a Biden administration, the maritime industry might see its star rise as it takes on an important role in the president-elect’s plan to reduce carbon emissions across all sectors of transportation. It’s very likely that the people he appoints to key positions — such as a new administrator at the Maritime Administration — will be charged with developing strategies to create “green shipping” as part of the Biden climate change agenda.

This could mean a bolder move toward more climate-friendly shipping fuels like LNG, methanol, ammonia and biofuels, as well as a more activist role for the U.S. in influencing global shipping policies through international organizations that had been pulled back during the Trump administration.

The offshore oil and gas industry should expect fewer opportunities for exploration and development as energy policy shifts to developing alternative fuels.

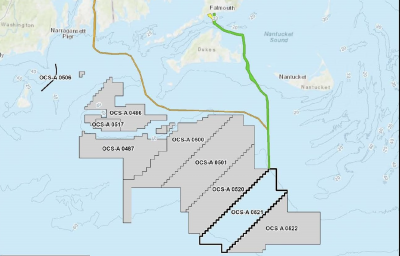

This would affect the offshore vessel sector but provide opportunities for workboats in the emerging offshore wind business. It would also boost arguments favoring barging as an environmentally friendly transportation mode and developing marine highway networks that use waterways to relieve land-side traffic congestion.

The robustness and success of these policies will likely depend on which party wins the majority of the Senate. A split government with Democrats controlling the White House and House of Representatives and Republicans controlling the Senate will make it more difficult for Biden to get his policies approved. Under this scenario, Biden would likely present a less ambitious agenda, but he will still be able to make many changes through regulation and executive orders, analysts say.